Signing up for PowerDetails Pay

PowerDetails has teamed up with Stripe to create PowerDetails Pay. Signing up allows agencies to receive electronic payments via ACH or credit cards on Estimates and Invoices from employers. Funds can then either be all deposited into the agency's bank account, or be deposited into the associated personnel bank accounts.

Accepting Electronic Payments

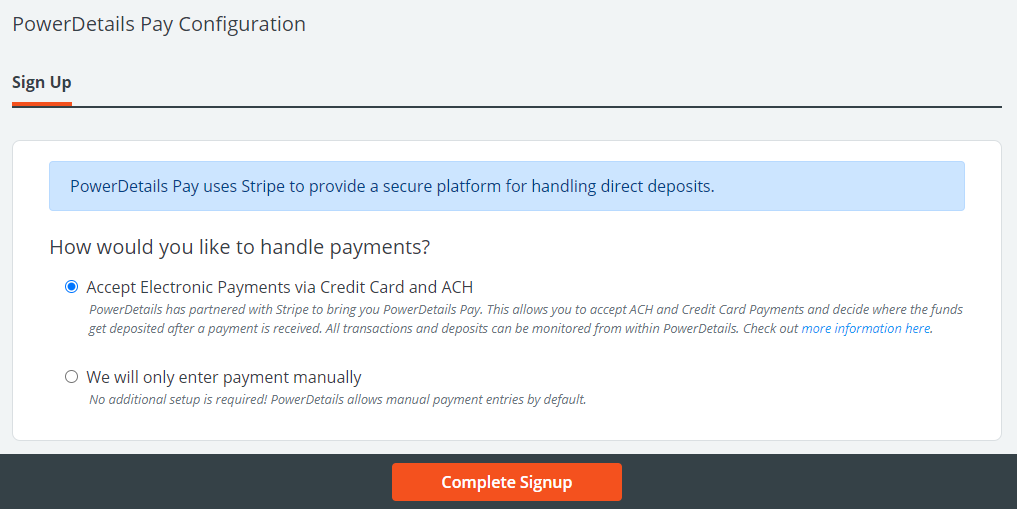

To sign up, an Administrator will go to Advanced on the top menu, hover over Site Config and click on PowerDetails Pay. The first Sign Up tab explains the two options for collecting payments in PowerDetails.

By default, you are able to record manual payments received outside of the PowerDetails system. Manual payments can still be entered even when choosing to accept electronic payments.

PowerDetails uses Stripe's secure platform to handle credit card and ACH payments. Similar to a convenience fee when paying online for a utility bill or other online services, PowerDetails charges a processing fee for each transaction. Click the button Complete Signup to indicate where payments get deposited.

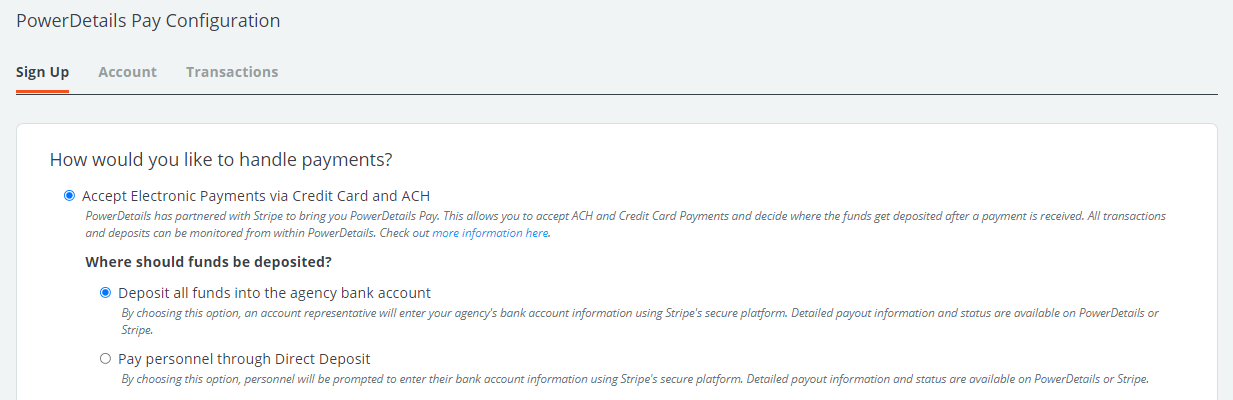

Deposit Settings

When choosing to accept electronic payments online, administrators will then need to choose where funds can be deposited. With either option, you will be prompted to enter the agency's account information in the Account tab. This will ensure any fee configurations that are payable to the agency can be deposited in the associated bank account.

Agency Direct Deposit

When choosing to deposit all funds to the agency bank account, the entire billing total for each line item on an estimate or invoice will be deposited. Payments and transactions can be monitored via the Transactions tab.

Personnel Direct Deposit

If you decide to pay personnel through Direct Deposit, the personnel (pay) totals related to personnel will be deposited directly into their bank accounts once they have entered their account information.

Personnel totals can be referenced on the Billing Approval page (if being utilized) and Billing History page. Any difference between the billed total and the pay total will be paid to the agency.

With this option, you will be able to indicate if certain fees are payable to the associated personnel or to the agency.

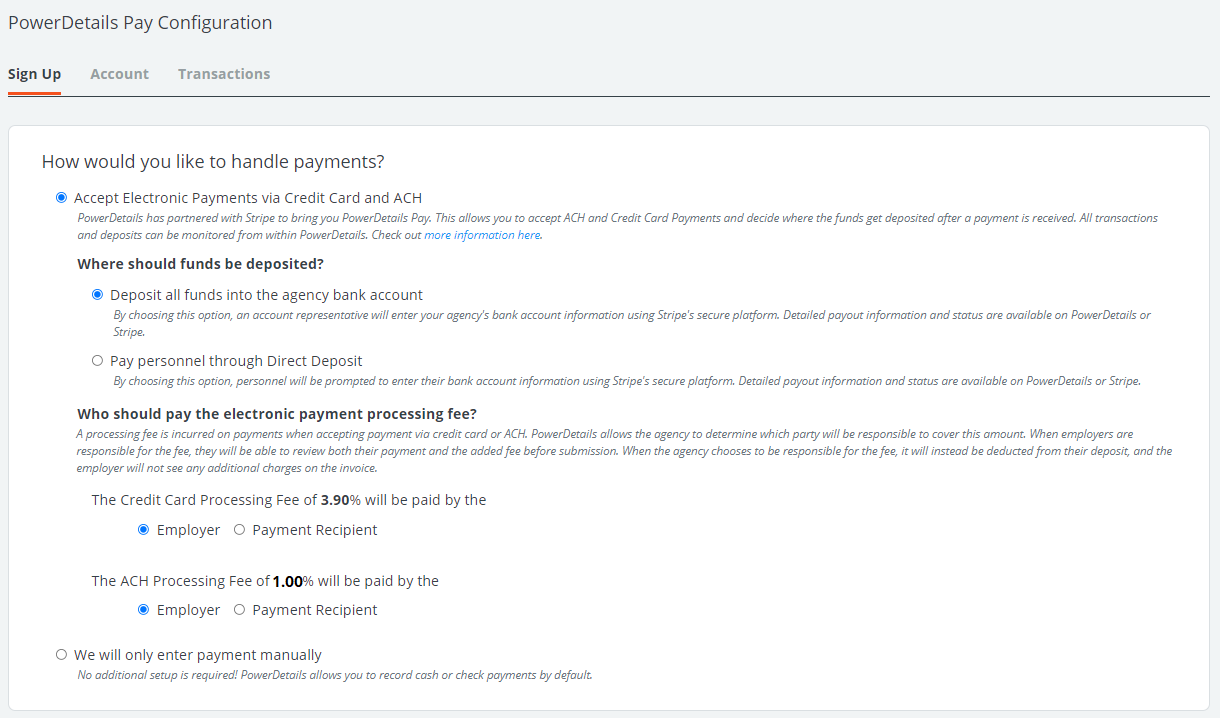

Processing Fees

Similar to paying online for a utility bill, PowerDetails charges a processing fee that is a percentage of each electronic payment transaction.

When depositing funds exclusively into the agency's bank account (option 1), you will be able to choose which party is responsible to pay the processing fee. When an employer is responsible for the processing fee, it will appear as an added fee when entering a credit card or ACH payment. After the payment is processed, the fee is reflected on the estimate/invoice alongside the payment for reference. When the agency is responsible for the fee, it will not affect the invoice total but will be deducted from the final deposit of the transaction to the agency.

When choosing to pay personnel through direct deposit (option 2), employers will always be responsible to pay the processing fee.

Processing Fee Examples

After being sent an estimate or invoice, an employer will click a button to make a payment online. Let's say we have a $100.00 invoice. This would incur a $1.00 processing fee if the employer chooses to pay via ACH.

If the employer is responsible for the fee, they will see an $1.00 additional charge when they walk through entering the payment. This is similar to a convenience fee seen when paying something like a utility bill. After the payment is processed, the payment and its corresponding processing fee will be recorded on the invoice for their records. The agency will see a $100.00 deposit in their bank account for this transaction.

If the payment recipient is responsible for the fee, PowerDetails would instead deduct $1.00 from what the agency receives. The employer will not see any additional charges when submitting the $100.00 payment online. A total of $99.00 would be deposited into the agency's bank account.

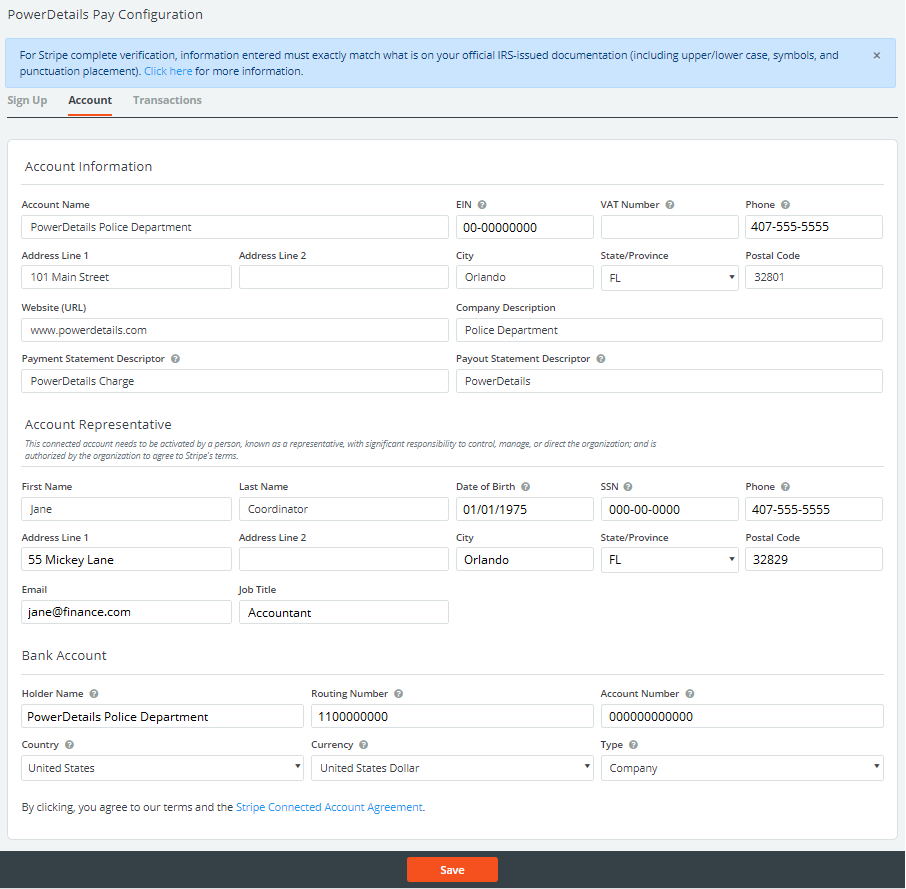

Entering Account Information

An account representative is required to enter the account information in the Accounts tab. Usually, this is someone in the finance department authorized to manage the agency account. Stripe's secure platform will require the representative to verify their own information as shown below to ensure a real person is overseeing account activity. Only the last 4 digits of the representative's social security number is required.

Note: A VAT Number is only required for businesses residing outside of the United States.

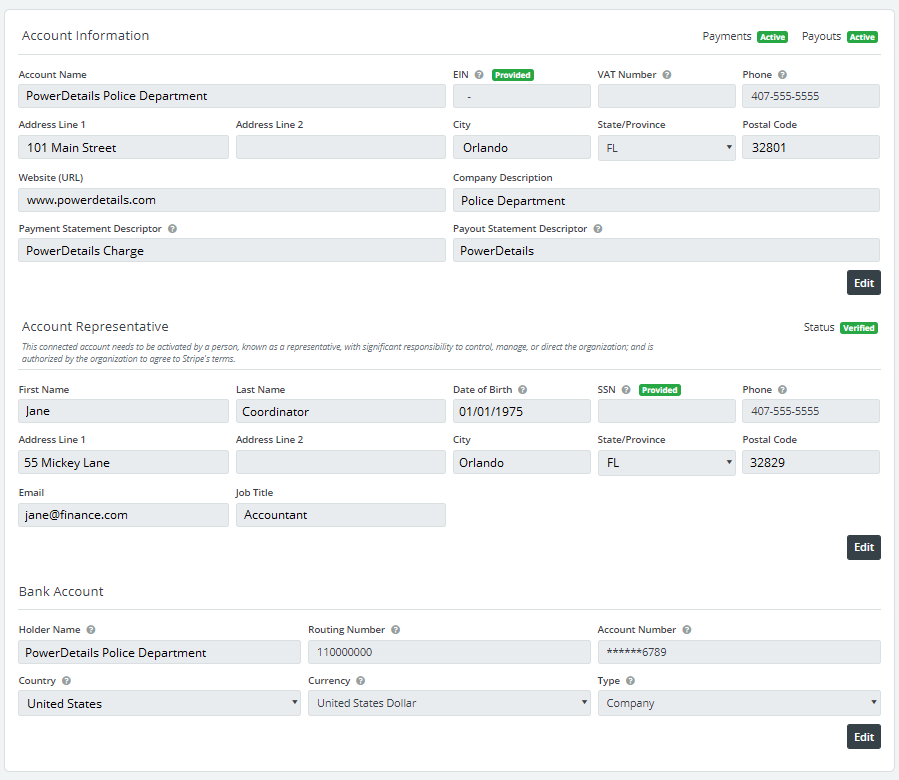

Account verification is nearly instantaneous. We recommend waiting about 1 minute, then refreshing the page. When verified, the updated status will display.

Once verified, you are ready to accept electronic payments! Information in the Account tab may be updated at any time, but will need to be re-verified. For security, EIN and Social Security Numbers will not display once verification is complete.

Read more in Payments about how to complete electronic transactions as an employer or administrator.

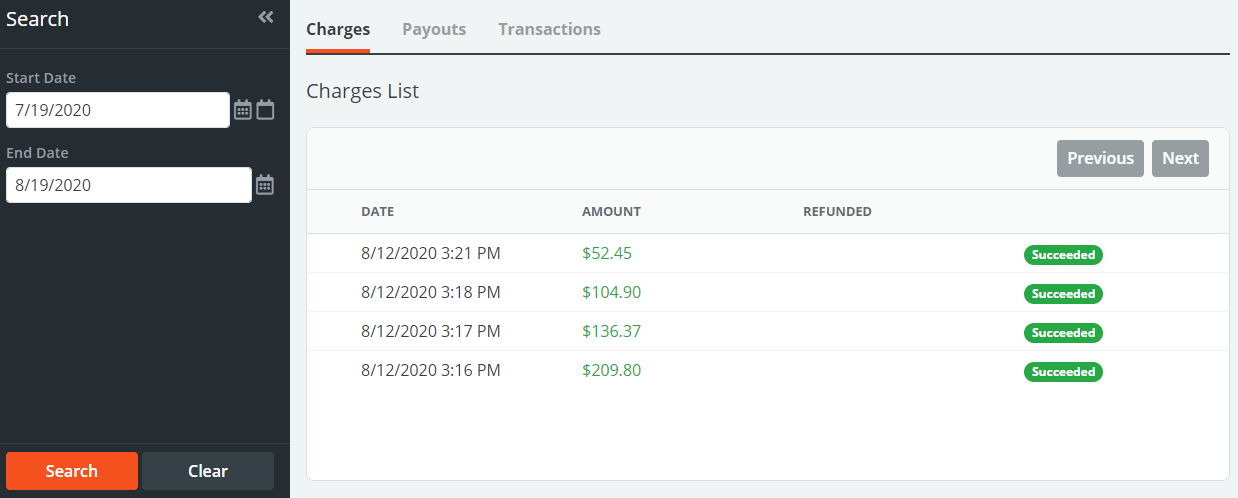

Monitoring Transactions

As transactions are processed, you will be able to monitor the charge status, payouts and refunds via the Transactions tab on this page.